Annuity

Whether it’s seeking better performance, guaranteed rate lock, or guaranteed lifetime income, we have the solutions.

Fixed Annuity

A fixed annuity is essentially a certificate of deposit (CD) sold by an insurance company and without the backing of the FDIC deposit insurance program. While CDs are great for low-risk short-term savings, fixed annuities are more suited to retirement savings, offering:

- Typically higher crediting rates over longer time horizons

- Tax-deferred growth

- The ability to annuitize at the end of the investment term

- Liquidity via penalty-free partial withdrawals

Introduction

Are you an insurance agent? If so, you’re likely familiar with annuities. An annuity is a contract between an insurance company and an individual that provides a steady stream of income during retirement. While they can be a valuable tool for your clients, many people are unaware of the benefits of incorporating annuities into their retirement planning. In this blog post, we’ll explore what annuities are, how they work, and why your clients should consider them as part of their overall financial plan.

Section 1: What are Annuities?

An annuity is a type of investment that you purchase from an insurance company. It’s designed to provide a steady stream of income during retirement, similar to a pension or Social Security. There are two main types of annuities: immediate and deferred. Immediate annuities start paying out right away, while deferred annuities accumulate value over time.

Section 2: How do Annuities Work?

When you purchase an annuity, you’ll either make a lump sum payment or a series of payments to the insurance company. The insurance company then invests your money, and you receive regular payments in return. These payments can last for a set period of time or for the rest of your life. Additionally, annuities can be structured to provide a death benefit to your beneficiaries.

Section 3: Why Should Your Clients Consider Annuities?

There are several reasons why your clients should consider incorporating annuities into their retirement planning. First and foremost, annuities provide a guaranteed stream of income during retirement. This can help alleviate concerns about running out of money or not having enough to cover expenses. Additionally, annuities can provide tax benefits, as the earnings from the investment grow tax-free until they’re withdrawn. Finally, incorporating annuities into a retirement plan can help balance risk and reward, providing a secure source of income while also allowing for more aggressive investments in other areas.

Conclusion

In conclusion, annuities can be a valuable tool for insurance agents to recommend to their clients. With guaranteed income, tax benefits, and balancing risk and reward, they’re worth considering as part of an overall retirement plan. As an insurance agent, it’s important to educate your clients about the different types of annuities and how they work, so they can make informed decisions about their financial future.

What Is a Fixed Annuity?

A fixed annuity is a tax-deferred retirement savings vehicle that provides fixed asset accumulation, much like a CD. With a fixed annuity, you can invest your savings over a specified time horizon (typically 3 to 10 years), earning a fixed return. The interest earned in your fixed annuity is not taxed until withdrawn, and your principal is guaranteed.

A fixed annuity is an annuity

An annuity is an insurance vehicle where a lump-sum amount is exchanged for a stream of payments going forward. What makes a fixed annuity an annuity is that it has the option to annuitize, or get the stream of payments, at the end of the investment term. You can also choose to leave your money invested at a renewable rate, withdraw all or a portion, or roll it over into a new fixed annuity. The distinction of being an annuity gives it its tax-deferred status.

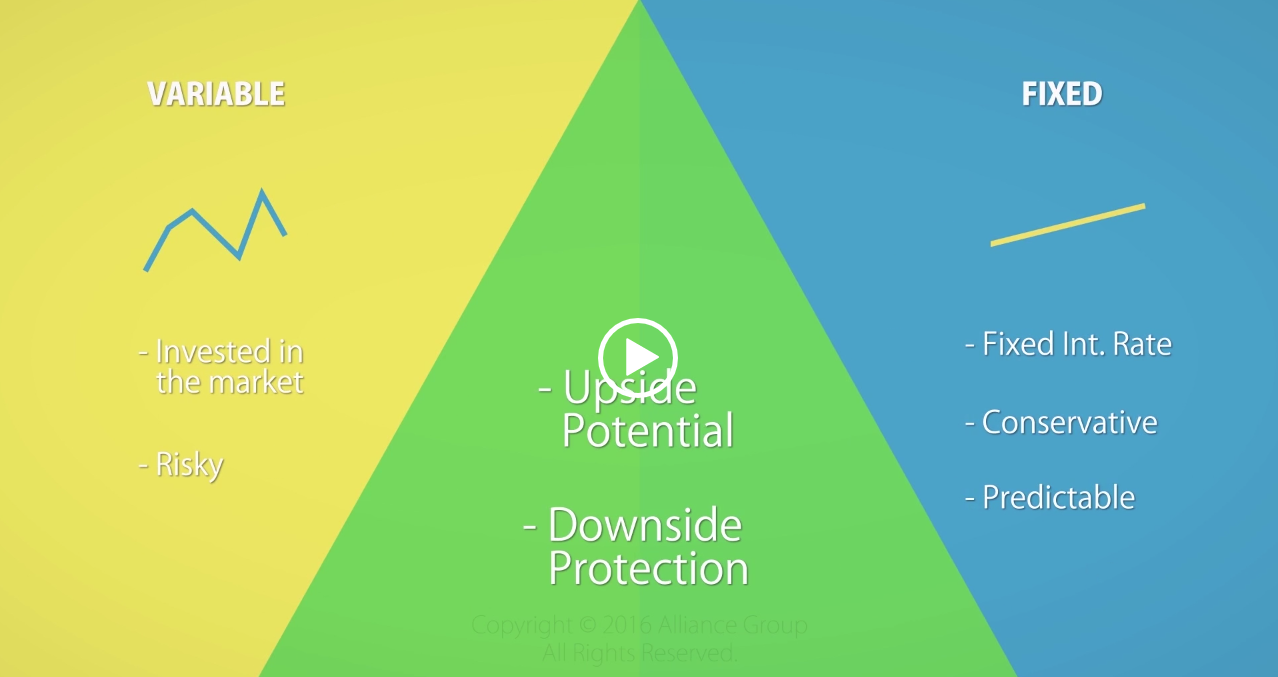

More specifically, a fixed annuity is an accumulation annuity

An accumulation annuity is bought for the growth potential of the money invested, and not as much for the ability to turn that money into income (as is the case with an income annuity). During the accumulation, or deferral, period your money will be invested with an insurance company and grow on a tax-deferred basis. You will often have some access to your money – typically the interest accrued or 10% of your balance – while it’s invested. Accumulation annuities grow either at a fixed rate (like fixed annuities) or grow based on market performance (as with variable and indexed annuities).

And finally, a fixed annuity is a multi-year guaranteed accumulation annuity

Fixed annuities earn a fixed rate over a multi-year time horizon. The interest rate will be specified upfront and will vary based on the amount you’re investing, your investment term, the credit rating of the insurer, and market conditions at the time of purchase. At the end of the guarantee period, the rate may change. In summary, a fixed annuity is an annuity that operates much like a CD, offering low-risk taxdeferred accumulation at a fixed rate.

Source: BluePrint Income

FAQ's & Terms

403(b) plan: In the United States, an arrangement that allows not-for-profit employers and their employees to make contributions to a tax-deferred retirement savings plan established for the benefit of employees. North American only accepts non-Erisa 403(b) plans.

457 Plan: In the United States, an arrangement that allows state and local governments and their employees to make contributions to a tax-deferred retirement savings plan established for the benefit of employees.

Accumulation Value: The sum of principal plus interest earned, minus withdrawals.

Annuitant: A person who will receive annuity benefits and whose lifetime is used to measure the length of time periodic income payments are payable under an annuity contract.

Annuitization: The process in which an annuity is paid out according to the annuity option the policy owner has selected.

Beneficiary: The person(s) to whom the death benefit is paid in the event of the death of the annuitant or owner of an annuity contract.

Claimant: A person who submits a claim to an insurance company.

Cost Basis: A contract owner’s initial investment in an annuity of after tax money, plus any additional funds invested in the same annuity at a later date. This applies to non-qualified annuities only.

Federal Deposit Insurance Corporation (FDIC): In the United States, a federal agency that insures deposits made into member banks and savings and loans up to $250,000 per person/per institution. Annuities are not subject to FDIC insurance.

Fixed Annuity: An annuity for which the insurer assumes the contract’s investment risk and guarantees to pay a specified rate of interest on the accumulated value for a specified period of time. Premiums paid for a fixed annuity are paid into an insurer’s general account.

Fixed Index Annuity: A Fixed Index Annuity that offers the potential of market-linked growth with the safety of a minimum interest rate guarantee over the term of the contract.

Free-look Period: The period after the owner receives the annuity contract in which the contract can be cancelled and treated as void from the contract date.

Guaranteed Interest Rate: The percentage return that is stated by the company to be paid on funds in an annuity.

Guarantee Period: A period of time during which the company will credit a stated rate of interest. The guarantee is usually one year unless stated otherwise.

Immediate Annuity: An annuity under which periodic income benefit payments are scheduled to begin one annuity period after the contract’s issue date.

Index Cap Rate: The Index Cap Rate is the maximum annual percentage increase in the Index Value that can be credited to the annuity.

Index Margin: Amount deducted from the index gain.

Inherited IRA: An IRA that becomes the property of someone other than the spouse of the deceased owner of the IRA.

Individual Retirement Account (IRA): In the United States, a retirement savings plan that allows people with earned income to deposit pre-tax earnings into a savings arrangement that is established by an individual and that meets certain requirements specified in the federal tax laws.

Interest Adjustment (also known as Market Value Adjustment): The impact of the Interest Adjustment is similar to how bond values are impacted by interest rates. The surrender value of your annuity will generally decrease as new money interest rates for your annuity product increase, which creates a negative adjustment to your surrender value. Alternatively, when new money rates for your annuity product have decreased since your Contract was issued, the surrender value generally increases due to the Interest Adjustment.

Joint Annuitant: A person who is one of two or more people who will receive annuity benefits .

Joint Owner: The person or other entity that enters into a joint contract of insurance with an insurer and actually jointly owns the insurance policy with another person or entity.

Maturity Date: The Maturity Date is the date on which income payments will begin from your annuity. With the exception of contracts that have a fixed Maturity Date which cannot be changed, the Maturity Date will automatically be set at the maximum Maturity Date allowed in your state, provided you have not requested a specific date on the annuity application. Please refer to your contract for the Maturity Date provision applicable to your annuity.

Non-Qualified Funds: Funds that have already been taxed. Non-qualified funds provide for the cost basis in the policy.

Owner: The person or entity to whom the contract is issued, who is entitled to exercise all rights and privileges under the contract.

Participation Rate: The percentage of index gain credited to the annuity.

Pre 59½ withdrawals (IRS Rule 72t): Early distributions from your retirement plan that must be “substantially equal” payments based upon one of the three methods approved by the IRS. Once the distributions begin, they must continue for a period of five years or until you reach age 59½, whichever is longest.

Premium: (sometimes referred to as Principal) The original amount of funds on which interest is calculated.

Premium Tax: A tax charged by certain states or any other governmental authority on either the premium payment or value of the Separate Account.

Probate: The legal process in which a court oversees the distribution of property left in a will. Annuities have the ability to avoid probate.

Qualified Funds: Funds that have not been taxed.

Required Minimum Distributions (RMDs): Annual amounts that participants in qualified retirement plans and owners of traditional individual retirement arrangements (IRAs) must begin to receive by the year following the year the person turns age 70½. Also known as minimum required distributions (MRD).

Retained Asset Account: A completely liquid, interest-earning account established for beneficiaries to invest their funds, allowing time to make decisions on future plans.

Riders: An addition to an annuity contract that becomes a part of the annuity contract and that is as legally effective as any other part of the contract. Riders usually expand or limit the benefits under the contract.

Roth IRA: In the United States, a type of individual retirement arrangement (IRA) that permits people within certain income limits to make nondeductible after tax annual contributions and to withdraw money on a federal tax-free basis at retirement age, assuming the contract has been in force for at least five years.

Section 1035 exchange: In the United States, a tax-free replacement of an insurance contract for another insurance contract or annuity covering the same person that is performed in accordance with the conditions of Section 1035 of the Internal Revenue Code.

Security: A certificate that represents either ownership interest in a business (for example, a share of stock) or an obligation of indebtedness owed by an institution (for example, a bond).

Simplified Employee Pension (SEP) plan: In the United States, a qualified employer-sponsored pension plan whereby an employer establishes and makes contributions into an individual retirement account or individual retirement annuity for each participating employee; however, the employee owns the account. Self-employed people also may establish a SEP plan. Also called SEP-IRA.

Surrender Charge: An amount charged to an annuity contract owner when he prematurely withdraws a portion or the entire contract’s accumulated value (over any penalty free amount). Also known as back-end load, contingent deferred sales load, and withdrawal charge.

Surrender Period: The period of time stated in the annuity contract during which a surrender charge will apply to any full or partial surrender that is in excess of the penalty free amount available.

Tax-Deferred Basis: Accumulation of interest on which income taxes are not payable until money is withdrawn from the annuity.

Fixed index annuities are not a direct investment in the stock market. They are long term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation.

Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders could under certain scenarios exceed interest credited to your accumulation value, which would result in loss of premium. They may not be appropriate for all clients.